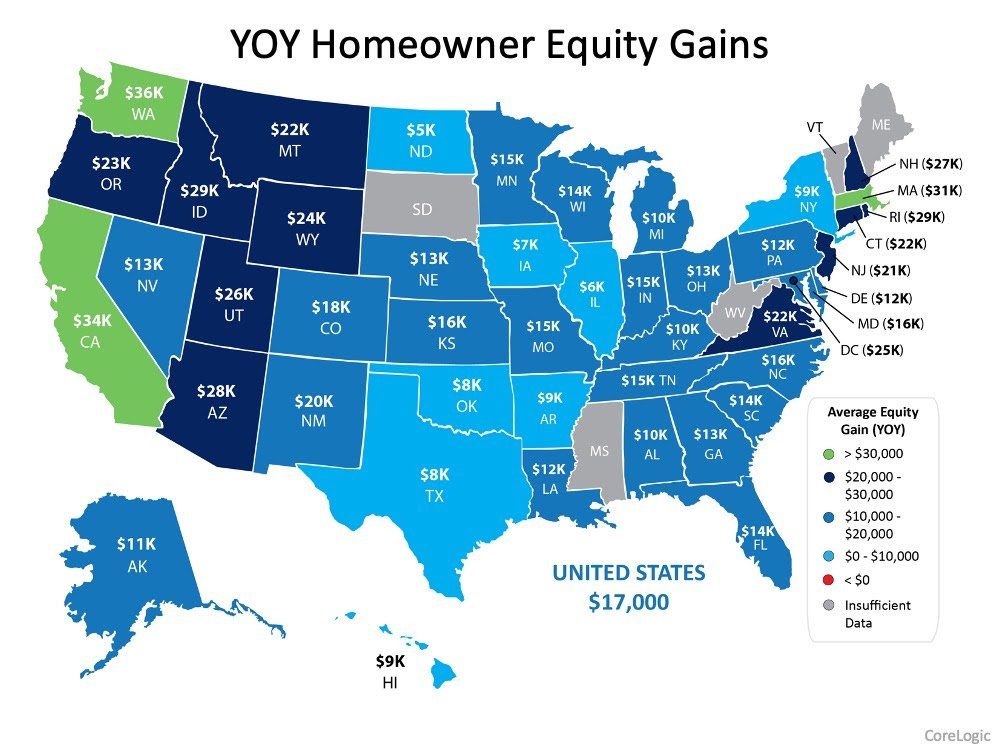

Homeowner Equity Increases an Astonishing $1 Trillion

Homeowner Equity Increases an Astonishing $1 Trillion

- U.S. homeowners with mortgages have seen their equity increase by a total of $1 trillion since the third quarter of 2019.

- The average homeowner gained approximately $17,000 in equity over the past year.

- This is a 10.8% increase in equity over last year.

- The average household with a mortgage now has $194,000 in home equity.

This gain in home equity is a blessing for homeowners in these trying times, and it seems that the next two years will continue to reward those who own a home.

Last week, the National Association of Realtors (NAR) held their 2020 Real Estate Forecast Summit. At the summit, they shared the results of a recent survey of 23 economic and housing market experts. The median forecast among the experts called for home values to increase further by 8% in 2021 and 5.5% in 2022.

Bottom Line

In a year that has many of us reevaluating what “home” really means, those who own their homes have been rewarded with a financial windfall that averages $17,000 individually and totals $1 trillion nationally.