Why Experts Say Mortgage Rates Should Ease Over the Next Year

You want mortgage rates to fall – and they've started to. But is it going to last? And how low will they go?

Experts say there’s room for rates to come down even more over the next year. And one of the leading indicators to watch is the 10-year treasury yield. Here's why.

The Link Between Mortgage Rates and the 10-Year Treasury Yield

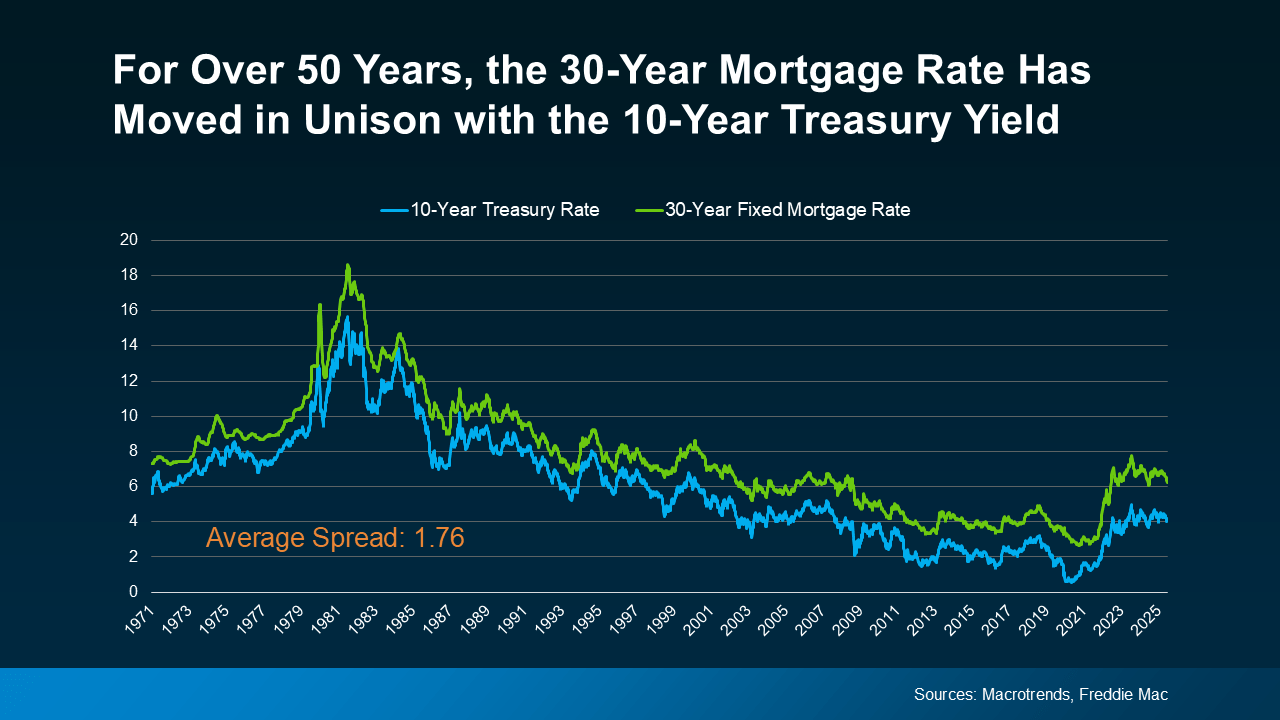

For over 50 years, the 30-year fixed mortgage rate has closely followed the movement of the 10-year treasury yield , which is a widely watched benchmark for long-term interest rates ( see graph below ):

When the treasury yield climbs, mortgage rates tend to follow. And when the yield falls, mortgage rates typically come down.

When the treasury yield climbs, mortgage rates tend to follow. And when the yield falls, mortgage rates typically come down.

It’s been a predictable pattern for over 50 years. So predictable, that there’s a number experts consider normal for the gap between the two. It’s known as the spread, and it usually averages about 1.76 percentage points, or what you sometimes hear as 176 basis points.

The Spread Is Shrinking

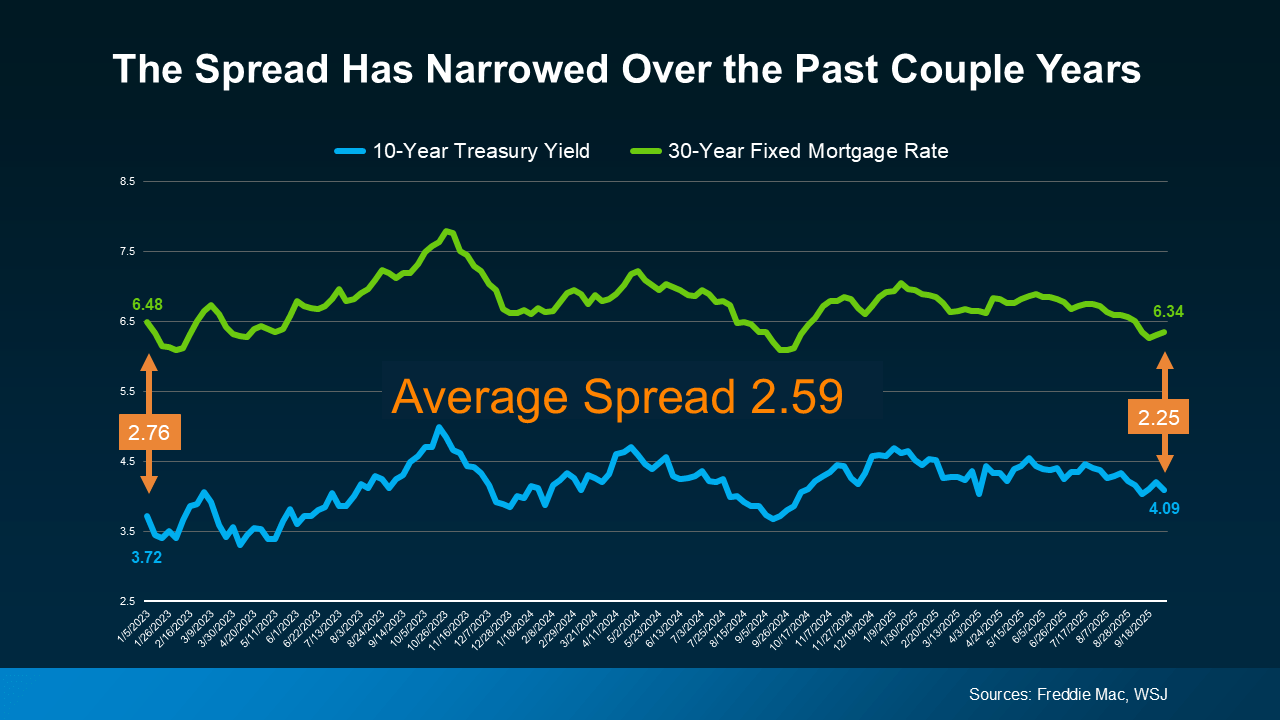

Over the past couple of years, though, that spread has been much wider than normal. Why? Think of the spread as a measure of fear in the market. When there’s lingering uncertainty in the economy, the gap widens beyond its usual norm. That’s one of the reasons why mortgage rates have been unusually high over the past few years.

But here’s a sign for optimism. Even though there’s still some lingering uncertainty related to the economy, that spread is starting to shrink as the path forward is becoming clearer ( see graph below ):

And that opens the door for mortgage rates to come down even more. As a recent article from Redfin

explains:

And that opens the door for mortgage rates to come down even more. As a recent article from Redfin

explains:

“A lower mortgage spread equals lower mortgage rates. If the spread continues to decline, mortgage rates could fall more than they already have.”

The 10-Year Treasury Yield Is Expected To Decline

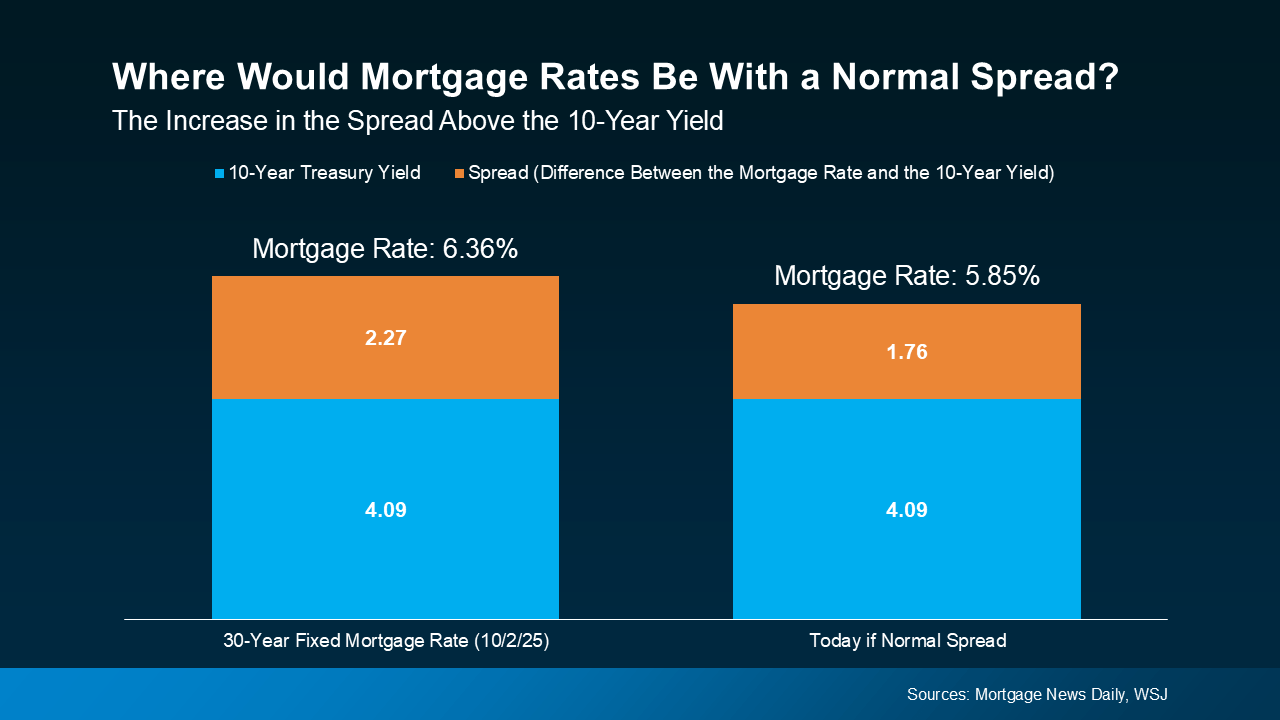

It’s not just the spread, though. The 10-year treasury yield itself is also forecast to come down in the months ahead. So, when you combine a lower yield with a narrowing spread, you have two key forces potentially pushing mortgage rates down going into next year.

This long-term relationship is a big reason why you see experts currently projecting mortgage rates will ease, with a fringe possibility they’ll hit the upper 5s toward the end of next year.

Here's how it works. Take the 10-year treasury yield, which is sitting at about 4.09% at the time this article is being written, and then add the average spread of 1.76%. From there, you’d expect mortgage rates to be around 5.85% ( see graph below ):

But remember, all of that can change as the economy shifts. And know for certain that there will be ups and downs along the way.

But remember, all of that can change as the economy shifts. And know for certain that there will be ups and downs along the way.

How these dynamics play out will depend on where the economy, the job market, inflation, and more go from here. But the 2026 outlook is currently expected to be a gradual mortgage rate decline. And as of now, things are starting to move in the right direction.

Bottom Line

Keeping up with all of these shifts can feel overwhelming. That’s why having an experienced agent or lender on your side matters. They’ll do the heavy lifting for you.

If you want real-time updates on mortgage rates, reach out to a trusted agent or lender who can keep you in the loop and help you plan your next move.